how to file tax in malaysia

The first part is about the preparation and things you SHOULD know before filing your tax retu. Go to e-Filing website.

How To File Income Tax For The First Time

How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

. On the first RM 600000 chargeable income. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for the year of assessment concerned. Following table will give you an idea about corporate tax computation in Malaysia.

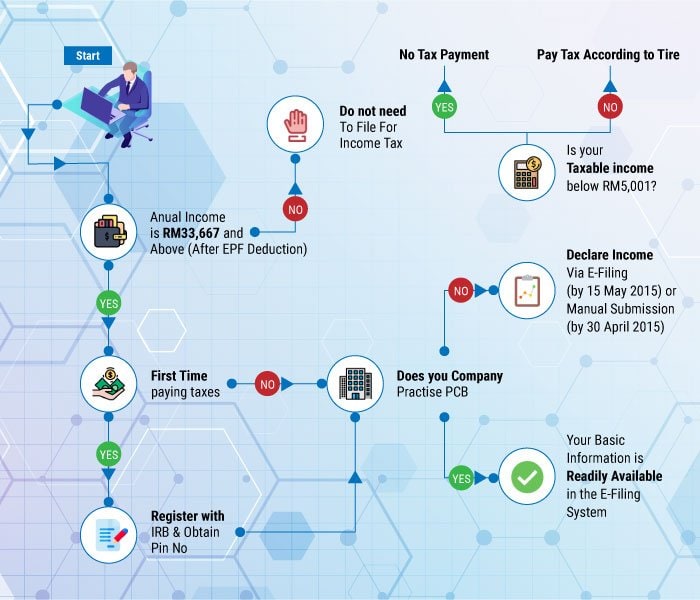

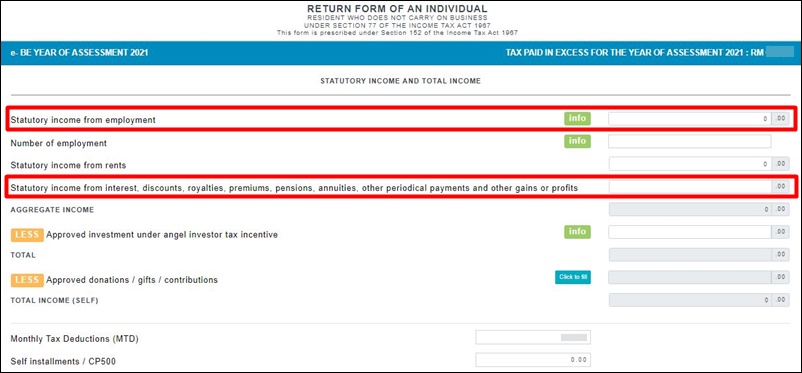

Choose the right income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. Companies limited liability partnerships trust bodies and cooperative societies which are.

Cukai Pendapatan How To File Income Tax In Malaysia Once you have the PIN head on to the e-Filing website and click on First Time Login. Here is the step-by-step guide for the e-Filing process. However it may be easiest for you - especially if youre not currently in Malaysia - to use their online filing.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e. You must be wondering how to start filing income tax for the. For the BE form resident individuals who do not carry on business the.

Login to e-Filing website. Heres a more detailed guide on how you should go about registering as a first-time taxpayer. 2 Logging in to e-Filing You can access e-Filing through ezHASiL or your tax.

Your TRF can be mailed to the Inland Revenue Board of Malaysia. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Procedures For Submission Of.

Meanwhile if you did not register your business then use the usual BE form for those with non-business income to file your tax as a freelancer instead. In this form they will need to. After that you can obtain your PIN online or by visiting a.

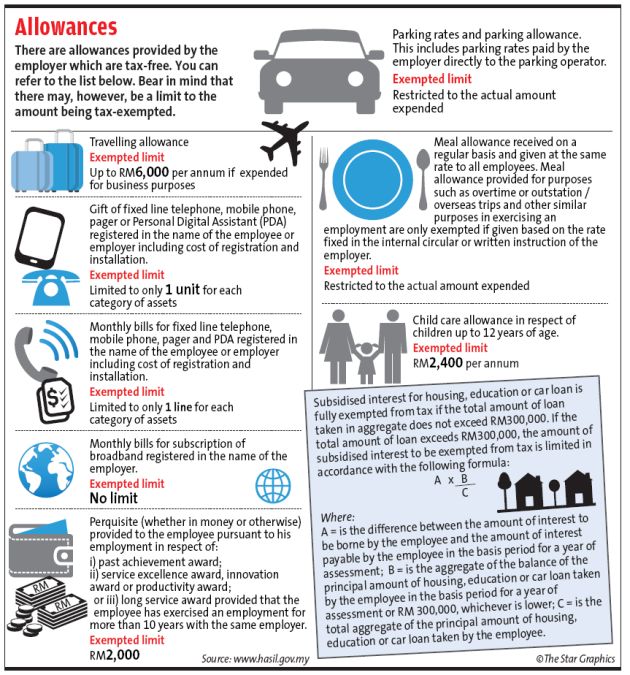

To complete a tax return expats need to fill out a Yearly Remuneration Statement EA form which is issued by the end of February every year. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia.

Click Online Registration Form Borang Pendaftaran Online fill in your details and log in to your account. The first part is about the preparation and things you SHOULD know before filing your tax retu. They need to apply for registration of a tax file.

As for your e-Filing PIN you can go to LHDNs website. Register for first-time taxpayer online via LHDN MalaysiaA. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Where a company commenced operations. Notice of assessment wil not be issued under SAS as the. Paid-up capital up to RM 25 million or less.

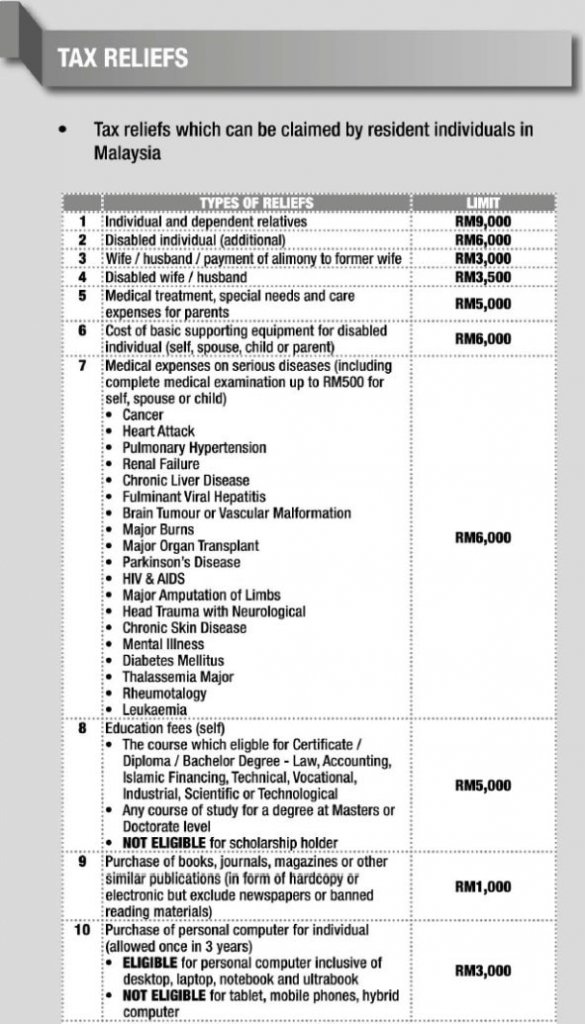

This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia. In this form you will. All individuals are required to file their taxes if they already have a registered tax file or if their annual income exceeds RM34000 after deducting their EPF contributions.

How To File Income Tax In Malaysia 2022 Lhdn Youtube

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

How To Charge Sales Tax In The Us A Simple Guide For 2022

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Top 10 Tips On Filing Your Tax Returns The Star

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Guide To Using Lhdn E Filing To File Your Income Tax

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Why It Matters In Paying Taxes Doing Business World Bank Group

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Dormant Companies In Malaysia Need To File Their Tax Returns Starting From Year Of Assessment 2014

Exclusive Malaysia May Cut Palm Oil Export Tax By Half Amid Global Supply Crisis

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

How To File Your Taxes As A Freelancer

Malaysia Personal Income Tax Guide 2020 Ya 2019

A Guide To Malaysian Tax For Expats

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

St Partners Plt Chartered Accountants Malaysia Malaysia Income Tax An A Z Glossary Want To File Your Income Tax In Malaysia 2019 But Don T Know What Half The Terms Mean From

I Filed My First Income Tax Tutorial For Beginner Tax Payers In Malaysia Youtube

0 Response to "how to file tax in malaysia"

Post a Comment